Solutions to Aging in Place.

We believe in early intervention. A little bit of support goes a long way!

Our Mission

Caring Companions' mission is to provide excellent home care services and innovative solutions to support seniors in aging in place, delaying or eliminating the need for institutional care.

We’re dedicated to the family caregivers who take on the rewarding and selfless role of helping their loved ones live independently for as long as possible. For spouses who become 24 hour caregivers and adult children who miss work to check in, skip classes to check up, juggle kids and spouses and jobs while caring for or worrying about your parents all at the same time, we have you in mind when we are thinking outside the box, and implementing innovative products and programs.

Our programs meet you where you are, help for today and tomorrow...

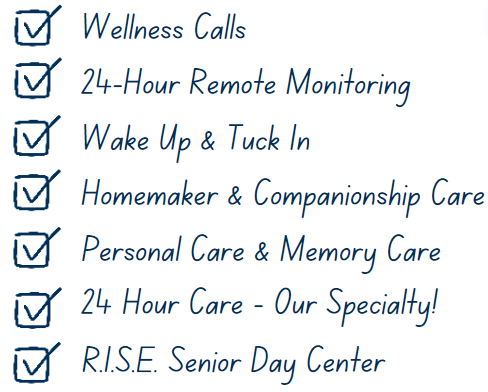

Wellness Calls

Scheduled check-ins calls throughout the day and week, reminders, companionship...

24-Hour Remote Monitoring

Using technology for peace of mind, with 24/7 response when needed...

24-Hour On-Call

Share-the-Care Plan

Starting at $99 per month, Access to on-call care when YOU NEED IT!

Personal Care

Help with all hygiene, toileting, mobility, caring for bed bound seniors...

24-Hour Home Care

Our specialty! Your team of caregivers will be scheduled around the clock...

R.I.S.E Senior Day Center

Antidote to Loneliness and Isolation. A fun and engaging day with friends...

Home—there’s no place like it. It’s where your memories were made. Where you raised your family and where friends have gathered for life’s celebrations. It’s been your basecamp through good times and bad. And it’s where you want to stay. At Caring Companions, our intention is to help you do just that. Why? Because we exist to be your guide to living successfully at home, wherever home may be. It’s our purpose.

Home care helps with daily activities...

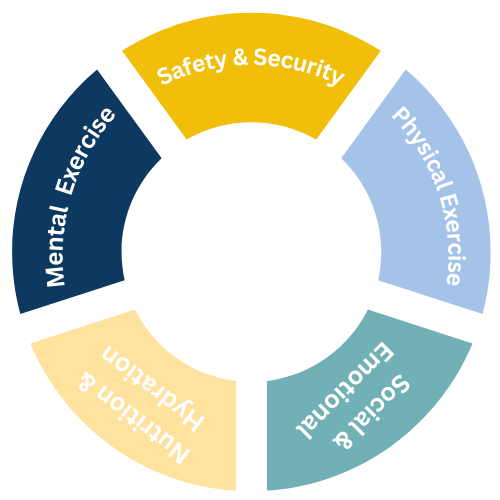

We focus on these 5 key factors when developing the client care plan.

Safety & Security:

Everything offered with our 24 Hour Remote Monitoring ensures safety and security.

Physical Exercise:

Motion is lotion! We use Grow Young Fitness to access chair exercises.

Social & Emotional:

Planned social activities, family communication and support, thoughtful services, and participation in R.I.S.E. keep your loved ones happy!

Nutrition & Hydration:

Whole foods, proper hydration, and specialized menu planning for disease management - we provide monthly chef prepared menus and approved by a dietitian.

Mental Exercise: Customized memory exercises and specialized activity planning to promote memory wellness

See why hundreds of Southwest Missouri Seniors choose Caring Companions

Ask Us Anything

We’ll get to know you and your family's needs.

Then we’ll work with you to develop a personalized Care Plan. Leave us your information, and we’ll contact you.

Want to speak with someone right now?

Call

(417) 234-8494

Contact Us

We will get back to you as soon as possible.

Please try again later.

Business Hours

Office Hours: Monday - Friday 8:00 am - 5:00 pm - Available by Phone 24/7

Share On: